What might your financial future hold?

FiScry

Do you have enough money to retire when you want to? Could you retire early? Do you know how much you can spend in retirement based on how much you are saving? What if you move to a cheaper city? How important is it to get that promotion early? Are you pursuing financial independence, or even "financial independence / retire early (FIRE)?"

FiScry can help.

Requires iOS 16.1+

We can’t predict the future, but we can learn from the past.

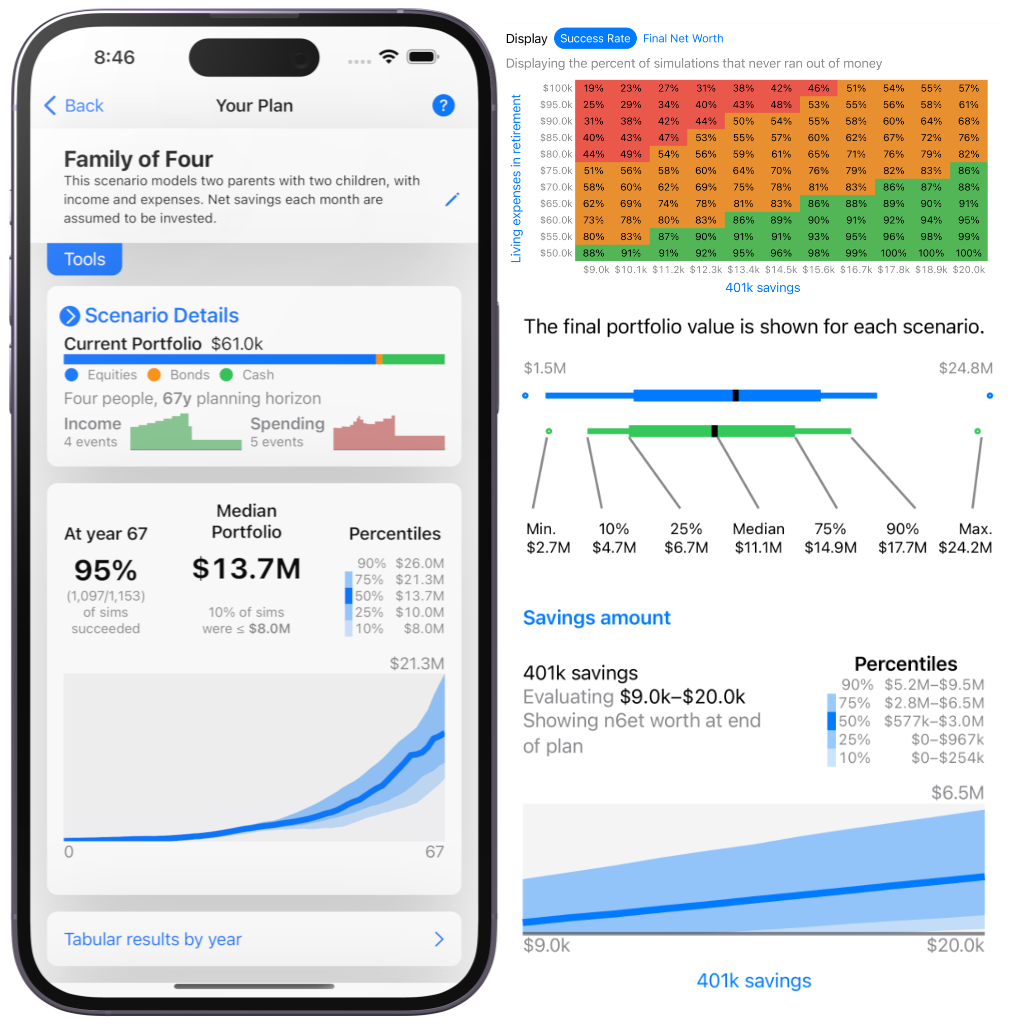

What FiScry does

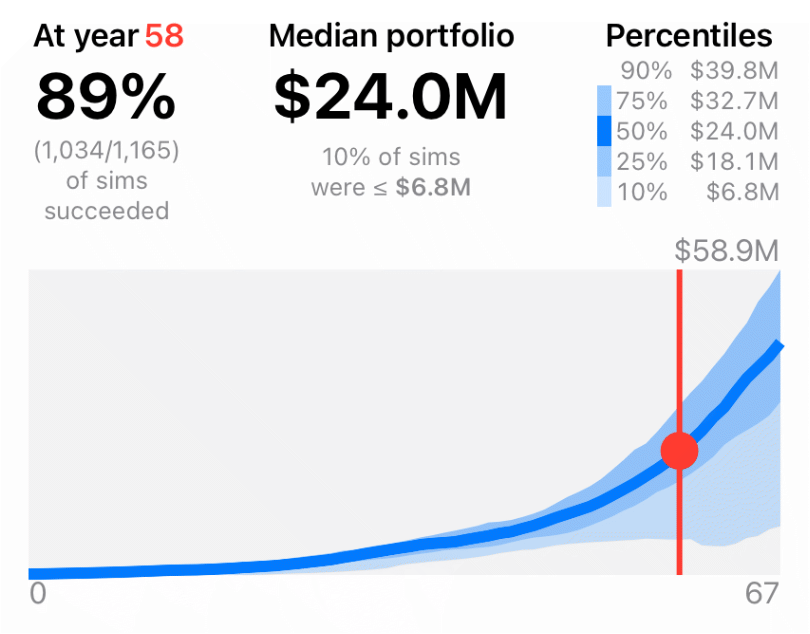

FiScry helps you describe your financial plan and then will “play back” historical market sequences. These market sequences are made of real historical monthly-resolution stock growth, dividends, bond rates, and inflation data.After simulating your saving and spending plans, FiScry shows a “percent succeed” metric that is the fraction of the time your plan never ran out of money among all of these real market sequences. For example, you will see a “median net worth” that is the “typical” value at the end of your plan (or in a selected year).

We care about your privacy

FiScry does not ask you to create a user account. Your data stays on your device. No personal data is collected.

Context, not financial advice

FiScry is an educational tool that tells you how your plan would have performed in past markets. We are not financial advisors and FiScry does not provide financial advice. What FiScry provides is context. For example: 1) Perhaps your plan only ran out of money in the worst 5% of all starting months of the last 120 years. Or 2) perhaps your plan will only succeed if the next 50 years outperform all previous historical market trajectories. The future will be different from the past, but FiScry helps you put your plan in context.

Keep it simple or get detailed. It's up to you.

Build Your Scenario

FiScry helps you build a scenario that describes your plans.

Your starting investment portfolio (in simplified terms of stocks, bonds, and cash)

People

Milestones (retirement, a child starting college, moving to a lower cost of living city)

Income

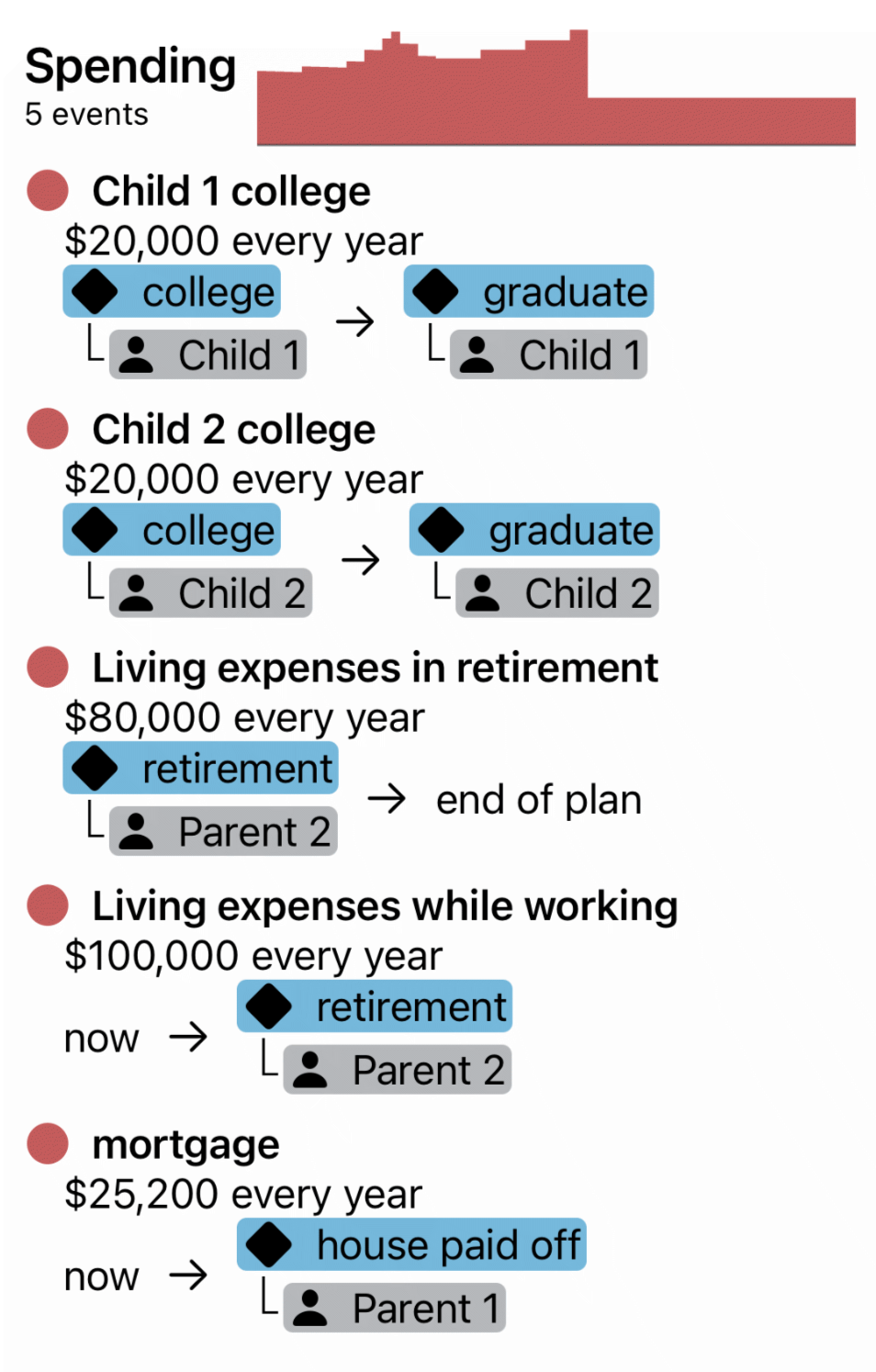

Spending

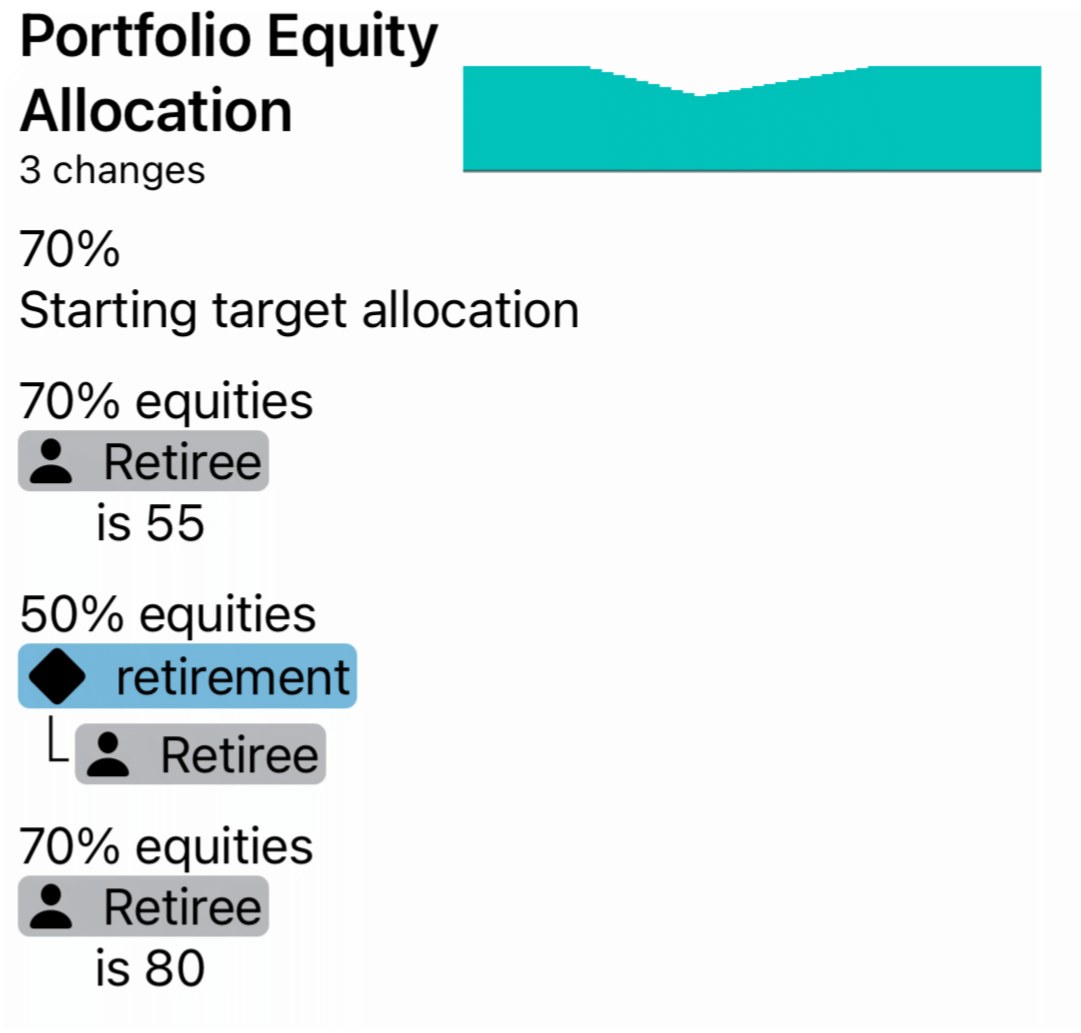

Changes to your investment portfolio equities allocation

Your plan can be as simple or detailed as you like, and we provide examples at both ends of the spectrum. A simple scenario might include only the amount you are saving for retirement right now, and it would switch to a single spending amount when retirement is reached.

explore the internals of your model

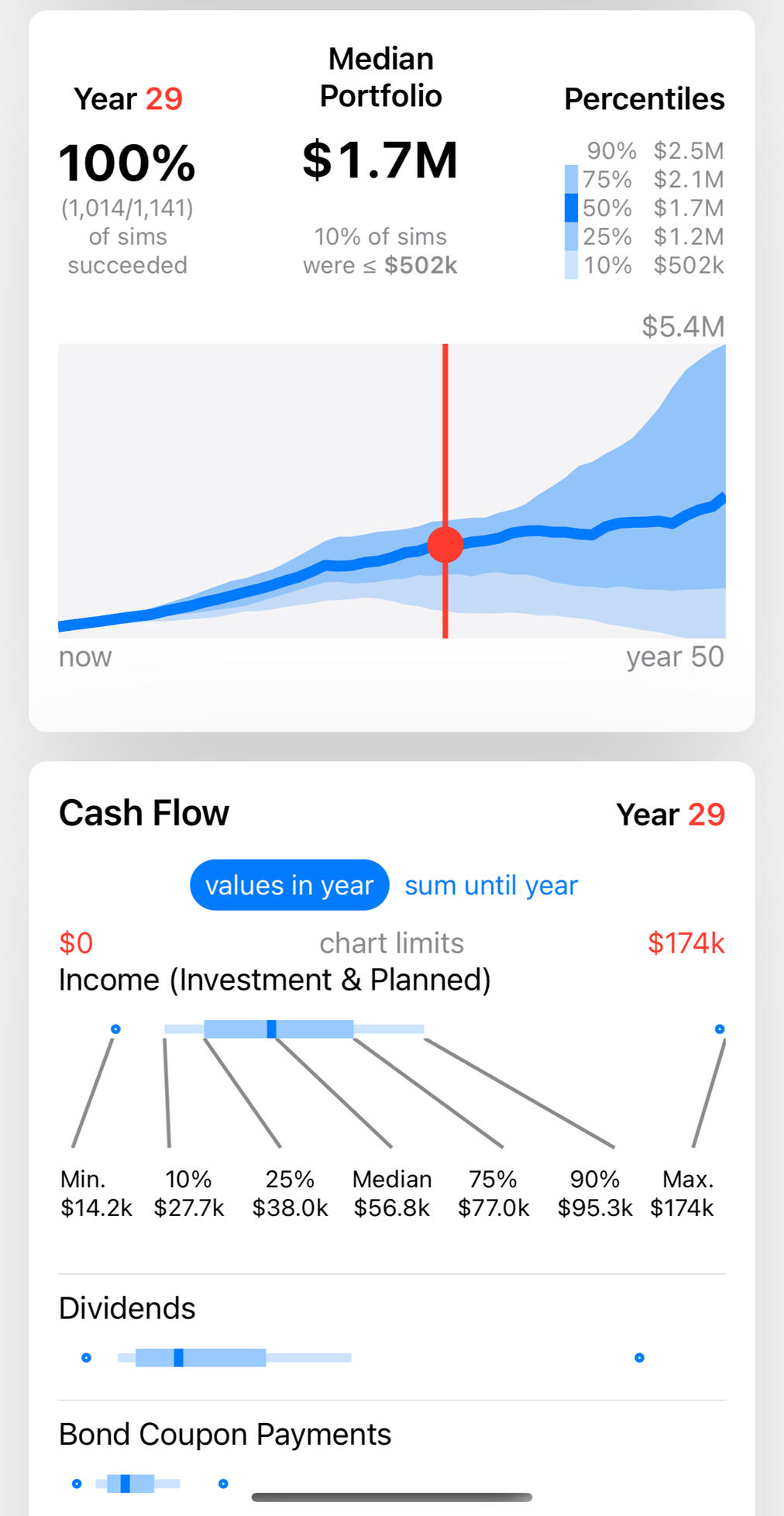

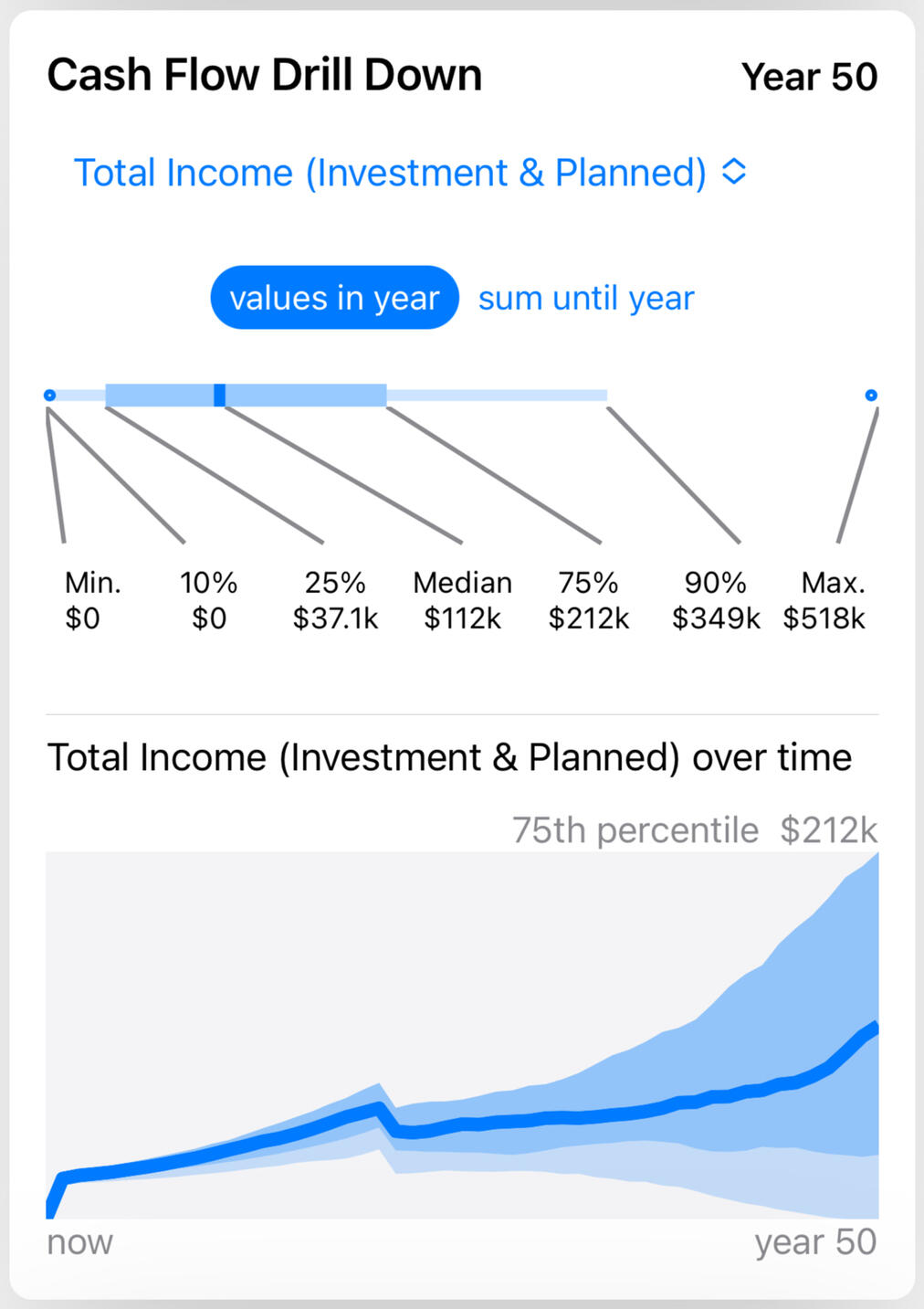

Drill Down Into Your Results

For each year that is modeled, there are a range of possible results for income. We let you explore this variability for your scenarios. See the real (inflation-adjusted) ranges for dividends, bond coupon payments, and total income (planned plus total investment returns).You can also see the range of spending shortfalls, if there are years where your plan didn't cover your expected spending needs.

Explore alternate plans

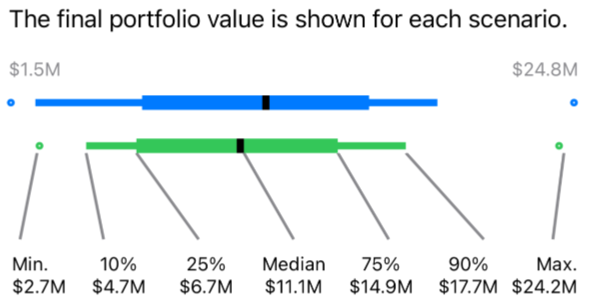

Compare Scenarios

Create multiple scenarios and compare them to each other. For example, what if you were to pay off your mortgage sooner, leaving less money to invest in the market in the meantime? How impactful is that, really?

Ask "what if?"

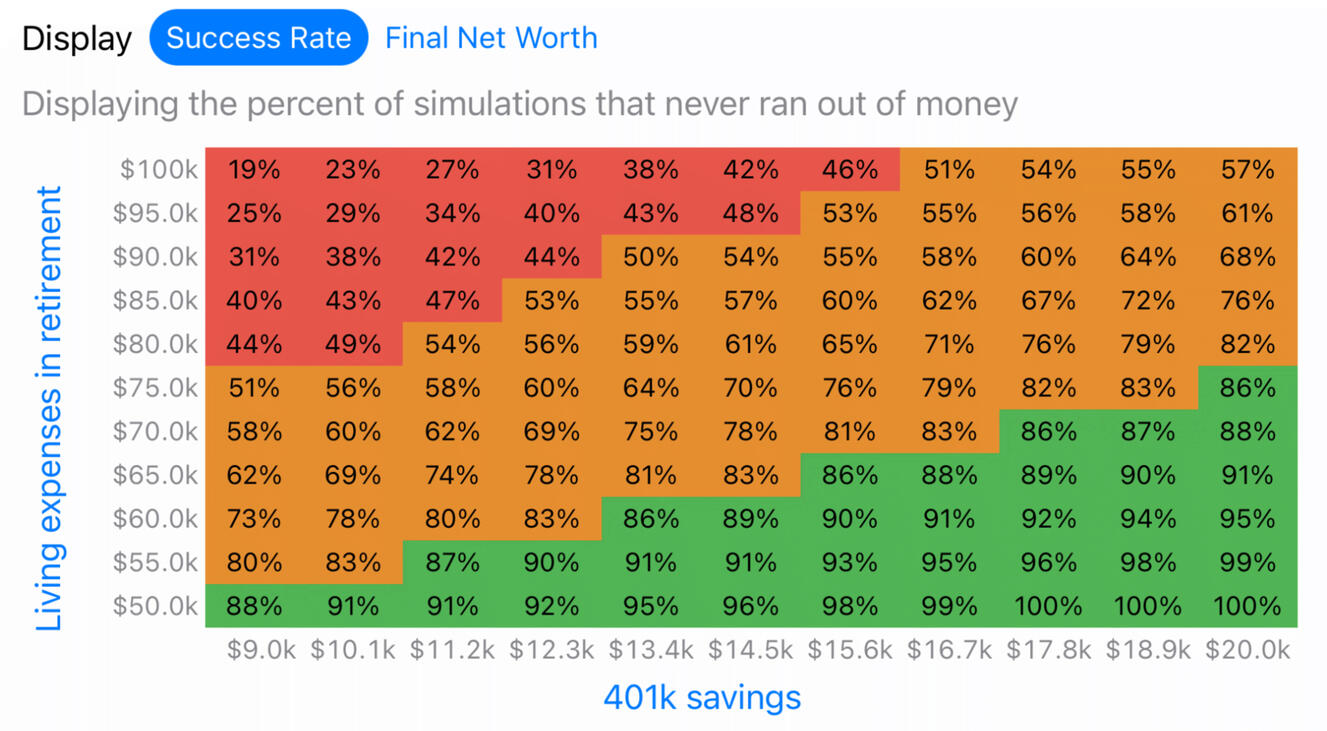

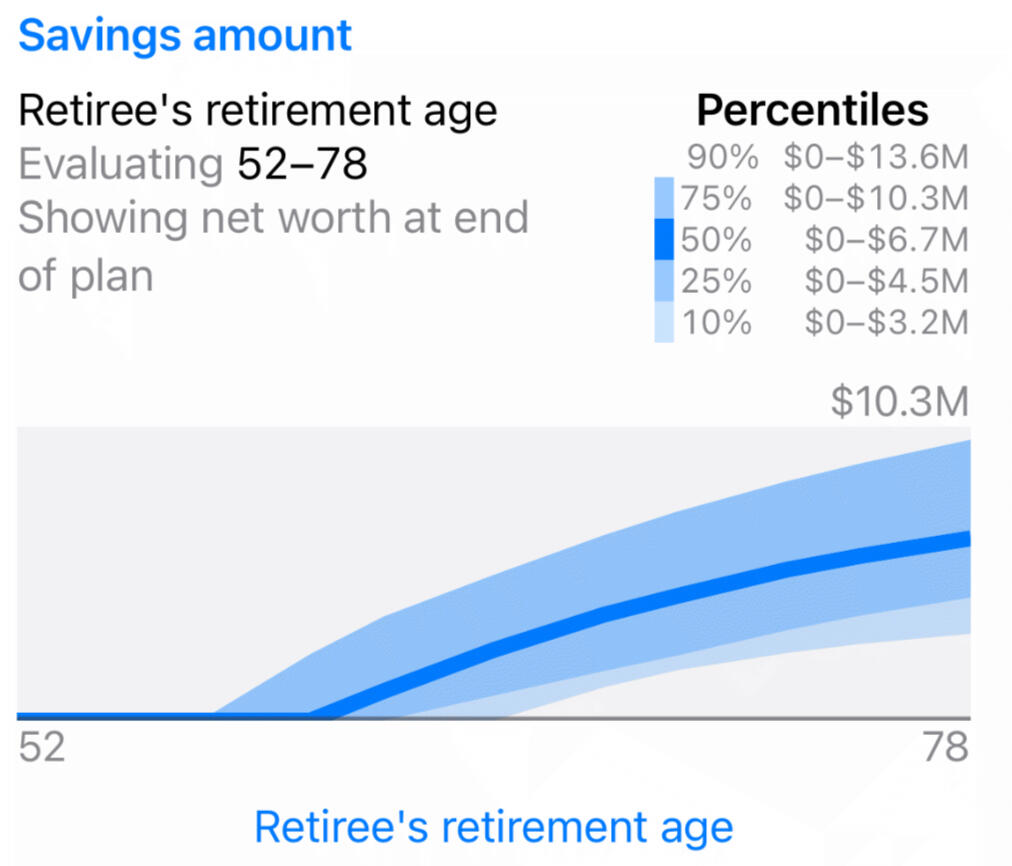

Sensitivity Analysis

FiScry helps you understand how making different choices could affect your plan with Sensitivity Analysis. This lets you explore what would happen in a range of values. For example, you can see what happens if you were to retire at all ages between 55 and 75. Or you could look at the combinations of changing the amount you are spending today, and how that interacts with how much you can spend in retirement.

Equity glide paths and bond tents

Change Asset Allocations Over Time

FiScry lets you model what would happen as you change your asset allocation (the percent of your portfolio that is equities). These changes can be linked to plan milestones, or just your age. For example, it is often recommended that we should increase the percent of bonds / fixed income assets in our portfolios as we age. How important is this? What about the concept of a "bond tent" where you increase the amount of bonds in the years approaching retirement, but then shift back to equities in the years after retirement? FiScry can model these types of changes.

Access where you want it

Cross-device sync

Your data is synced to all of your Apple devices using iCloud.We support iPhone and iPad. Apple Silicon devices running macOS (recent MacBooks for example) can run FiScry by downloading the iPad version from the App Store.

Monthly model resolution

Unlike most other tools, FiScry models your financial scenarios using monthly-resolution market history data,

not just once per year. This better captures the true market volatility you will experience as your plans unfold.

Planning for complexity

If you like to be more granular in your financial planning, FiScry has you covered.

Inflation-adjusted

Input your future plans and see distant financial outcomes translated to "today's dollars."

© Disparate Elements LLC. All rights reserved.

Your device performs all calculations

How Does FiScry Work?

For every month of market data, we start a simulation series that lasts for as long as the longest time horizon for any person in your plan. For example, if we are simulating a 30-year period using market data from 1925-2022, we perform 1,164 360-month simulations, using market data starting in each of 1,164 months.

For every simulated month, FiScry does the following:

Calculate the previous month’s market impact on your portfolio (inflation-adjusted stock and bond price changes, dividend yield, bond coupon payments). Dividend and bond payments are collected as cash.

Handle any income streams that you’ve entered and add these to the cash balance.

Handle any expenses that you’ve entered. If the cash pool is sufficient to cover it, then the expenses are subtracted from the cash pool.

If there are any expenses unmet by the cash pool, withdraw from your investment accounts by selling assets. Asset sales are done in a way that moves toward your target asset allocation. In other words, if you are currently overweight in equities compared to your target allocation, we will sell equities first to generate cash for your expenses.

Any remaining cash is invested, and the portfolio is rebalanced to your target asset allocation.

Every January the simulation state is captured for display in graphs and tables.

Privacy Policy

We take your privacy seriously. We don’t use or like ad tech, and avoid it in the apps we download for our own use. We do not sell or rent your data. Any usage data we collect is anonymized, and used only by us to make the app better, or to manage your subscription.The app assigns you a random user ID that is used to track your subscription status and we can use that ID to help you if you have problems. We have no way to link that ID that to your Apple ID or email address. We can't link any usage data back to your personal identity, your browsing habits, or any information about you outside of the app.FiScry sends anonymized usage data to us about what features are being used so that we know what parts of the app are popular and may deserve to be expanded, and to know what might not be working well. For example, we collect data about what size screens are being used, OS versions, and whether the app has crashed. We collect data about the number of times features are used (for example, how often people open the help system, or create a scenario that changes the percent equities over time).Collected usage data never includes any financial information or dollar values.Fiscry uses Mixpanel to collect this anonymized usage data, and it is not shared with any other company.If you have questions please contact us.

No ads.

No tracking. No Ad Tech.

We don’t monetize your data.

© Disparate Elements LLC. All rights reserved.

About Us

Disparate Elements is a husband-and-wife team of engineers. We've always had interests in finance and data analysis. A few years ago we had to figure out the answers to some of these questions for ourselves. However, we couldn't find any tools to help us, so we created our own. After letting the idea percolate for a few years we decided to translate the tools we created into a mobile app, and FiScry is the result!

If you have a question, bug report or feature request, please email us at [email protected].

© Disparate Elements LLC. All rights reserved.